Breaking News

Financial results 2025 (18 February 2026)

Financial results at 31 December 2025

Success of Lead the Future 2023-2025 strategic plan 2025 objectives fully achieved

-------

Commenting on these good results, Christel Heydemann, Chief Executive Officer of the Orange group, said:

“In 2025, we successfully completed our Lead the Future strategic plan: Orange is now simpler, stronger, and more efficient. By refocusing our efforts on value creation, we have strengthened our position in a rapidly changing global digital market. Our 2025 objectives were fully achieved, and I would like to thank all Orange teams for their hard work and commitment, as well as our customers for their trust.

We maintained our leadership positions in a very competitive European market. Our customer bases in Europe and Africa & Middle East continued to grow and we now have more than 340 million customers. Africa & Middle East confirmed its role as a growth driver, recording an eleventh consecutive quarter of double-digit growth.

The last quarter of the year was decisive in terms of strategic moves: in Spain, we signed a binding agreement with Lorca to acquire full ownership of MasOrange. With the closing of the transaction in 2026, Spain will become our second-largest market in Europe, and we will be able to benefit fully from the value created by MasOrange.

PremiumFiber, the FiberCo joint venture with Vodafone and GIC, began operations in the fourth quarter in Spain. With more than 12 million access lines and nearly 5 million connected customers, it is the largest FiberCo in Europe in terms of customers.

In France, along with Bouygues Telecom and Free-Iliad Group, we submitted a non-binding joint offer in October to acquire a large part of Altice's activities in France. Due diligence work on this project began in January 2026.

This transaction would strengthen investments in very high-speed broadband network resilience, cybersecurity, and key new technologies such as artificial intelligence, and consolidate control over strategic infrastructure in France, while maintaining a competitive ecosystem for the benefit of consumers.

There is no certainty at this stage that an agreement will be reached, and we remain focused on the execution of our strategy.

On the back of these results, we will present our strategic priorities and financial outlook for the 2026-2028 period at our Capital Markets Day, tomorrow, 19 February.”

This transaction would strengthen investments in very high-speed broadband network resilience, cybersecurity, and key new technologies such as artificial intelligence, and consolidate control over strategic infrastructure in France, while maintaining a competitive ecosystem for the benefit of consumers.

There is no certainty at this stage that an agreement will be reached, and we remain focused on the execution of our strategy.

On the back of these results, we will present our strategic priorities and financial outlook for the 2026-2028 period at our Capital Markets Day, tomorrow, 19 February.”

-------

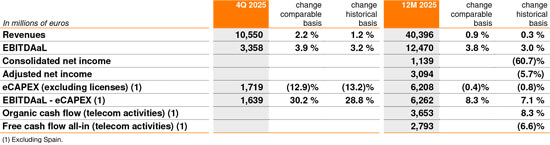

2024 revenues for 2025 was 40,396 million euros, up 0.9% year on year1 (+374 million euros) thanks to growth in retail services (+2.2% or +675 million euros). The momentum seen in retail services was partly offset by a decline in wholesale services (-3.9% or -229 million euros).

2024 revenues for 2025 was 40,396 million euros, up 0.9% year on year1 (+374 million euros) thanks to growth in retail services (+2.2% or +675 million euros). The momentum seen in retail services was partly offset by a decline in wholesale services (-3.9% or -229 million euros).

- Africa & Middle East was the main contributor to this growth, with revenues up 12.2% (+918 million euros), driven by increases from its four growth engines (+18.6% in Mobile data, +18.4% in Fixed broadband, +18.0% for Orange Money and +10.4% in B2B).

- In France, the commercial performance was solid with a record quarter for fiber (the best net additions since the fourth quarter of 2022). In a market that remains competitive, the growth in retail services excluding PSTN2 for the year was +0.6% (68 million euros). The structural developments in wholesale services (-6.5% or -286 million euros) continued to weigh on revenues, which resulted in a 2.1% decline (-377 million euros) year on year.

- Revenues in Europe rose 2.2% (+156 million euros) mainly due to the growth in retail services (+3.0%).

- The downward trend in Orange Business revenues (-4.8% or -367 million euros) was again due to the decline in Fixed-only revenues (-7.6% or -223 million euros). Revenue growth for Orange Cyberdefense was dynamic (+6.8% or +80 million euros), while IT and integration services were down (-2.3% or -86 million euros) in a tight IT market.

- In terms of commercial performance, the Group maintained its leadership position in convergence in Europe (including France), with a total of 9.3 million convergent customers (+1.9%). Mobile services had 272.8 million accesses worldwide (+7.8%). Fixed services had 38.1 million accesses worldwide (-0.6%) of which 16.5 million were very high-speed broadband accesses, an area that continued to show strong growth (+13.0%).

-------

The Group's EBITDAaL increased 3.8% to 12,470 million euros (+457 million euros), fully in line with the target of at least +3.5% growth, a target twice revised upward in 2025. This solid performance was driven by a double-digit increase in Africa & Middle East (+13.9%), as well as solid growth in Europe (+3.2%) and France (+0.9%). Orange Business continued to improve its EBITDAaL trend (-6.3% vs -8.4% in 2024), despite a difficult macroeconomic and market environment. Growth in EBITDAaL reached +3.9% in the fourth quarter, maintaining the momentum of previous quarters.

EBITDAaL from telecom activities was 12,522 million euros (+3.0%), with a 0.6-point improvement in the EBITDAaL margin. This increase was possible due to sustained operational efficiency efforts which enabled the Group to reach its efficiency target of 600 million euros over the past three years.

eCAPEX was lower (-0.4%, or -23 million euros) at 6,208 million euros, representing 15.4% of revenues and in line with the objective of eCAPEX discipline. The Group consolidated its leadership in fiber with 65.53 million households connectable to FTTH worldwide at 31 December 2025 (+9% year on year), and a FTTH customer base of 15.4 million (+14.0% year on year).

Operating income was 3,422 million euros (-36.0%, or -1,925 million euros) due to increased costs related to the French part time for seniors plans, the depreciation of the copper dismantling asset and accounting for the impairment of Orange Business activities.

2025 marked the beginning of the industrial phase of the gradual closure of copper lines, in line with the decommissioning plan announced in 2022. In this context, a provision of 1,676 million euros was recorded in 2025. This corresponds to the best estimate of the discounted costs associated with the dismantling obligation. This provision will be reversed as actual costs materialize. Conversely, a dismantling asset was recorded and will be depreciated over the remaining useful life of the copper network, which is until 2030. Accordingly, a depreciation expense of 368 million euros was recognized in 2025.

Adjusted net income4 for the consolidated Group was 3,094 million euros. This new indicator enables the Group's performance to be tracked excluding the main accounting impacts of exceptional or non-recurring items. Consolidated net income was 1,139 million euros, mainly affected by:

- The commitment linked to the agreement on Employment and Career Path Planning in France (GEPP) signed in February 2025 (amounting to 1,244 million euros net), and mainly related to the 2025–2028 French part time for seniors plan

- Depreciation of the copper dismantling asset (368 million euros)

- Recognition of an impairment for Orange Business activities of 332 million euros

Net income attributable to owners of the parent company came to 2,458 million euros.

Adjusted earnings per share (EPS), Group share, was 0.86 euros.

Organic cash flow4 at 31 December 2025 amounted to 3,653 million euros, in line with the annual target of at least 3.6 billion euros. This improvement in cash flow generation of +8.3% year on year (+281 million euros) was mainly due to the improvement in EBITDAaL from telecom activities (+295 million euros).

Free cash flow all-in5 amounted to 2,793 million euros (-6.6%), impacted by the staggered telecom license payments between 2024 and 2025.

Net financial debt, was 22,526 million euros at 31 December 2025. The ratio of “net financial debt to EBITDAaL from telecom activities” fell to 1.80x at 31 December 2025, in line with the target of a ratio of around 2x in the medium term. The liquidity position of the telecom activities was very solid at 21.3 billion euros and the average cost of gross debt was 3.12%.

On 6 November 2025, Orange successfully completed a bond issuance for a total amount of 5 billion euros, followed by a bond issuance of 6 billion US dollars on 6 January 2026. This latest issuance was more than 8 times oversubscribed.

For the full year 2025, the payment of a dividend of 0.75 euros per share will be proposed to the 2026 Annual General Meeting of Shareholders.

Orange shares finished 2025 with a total shareholder return of +56%6.

On 6 November 2025, Orange successfully completed a bond issuance for a total amount of 5 billion euros, followed by a bond issuance of 6 billion US dollars on 6 January 2026. This latest issuance was more than 8 times oversubscribed.

For the full year 2025, the payment of a dividend of 0.75 euros per share will be proposed to the 2026 Annual General Meeting of Shareholders.

Orange shares finished 2025 with a total shareholder return of +56%6.

- Unless otherwise stated, percentage changes are on a year-on-year basis, calculated against 31 December 2024 and on a comparable basis.

- Public Switched Telephone Network

- Including MasOrange and the FiberCos, FTTH homes connectable = c.100m

- Adjusted net income: see the glossary in appendix 5

- Telecom activities

- Source Bloomberg

Orange unveils “Trust the future”, a new strategic chapter built on trust to unlock growth

- After successfully delivering all the ambitions of Lead the future 2023–2025, Orange opens a new chapter for the next 5 years.

- Trust the future places trust as a key competitive advantage, at the heart of the Group's services and operating model, to reinforce its role as the trusted partner for always-available connectivity, broader digital services, and to unlock a new phase of growth.

- The plan is structured around three ambitions to leverage its strong customer base — Customer intimacy, Innovative growth and Excellence at scale — and is underpinned by strong commitments to the people, society and the planet.

- The expected full reconsolidation of MasOrange in H1 2026 is anticipated to significantly strengthen the Group's profile.

- Group Organic Cash Flow is expected to grow double-digit and reach c.€5.2bn by 2028. The Group intends to maintain an attractive remuneration policy for its shareholders, with progressive dividend growth and a new floor set at €0.85 in 2028, while maintaining a solid balance sheet.

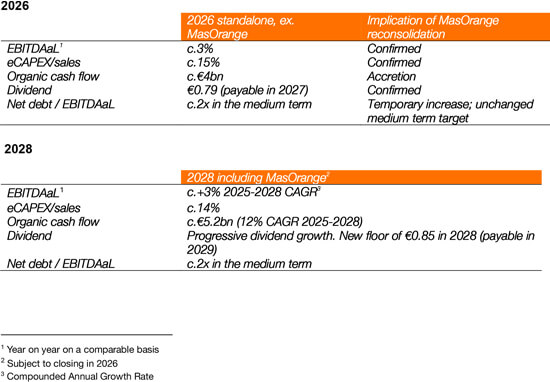

Sustainable value creation is the north star. Trust the future will drive profitable and sustainable growth, with an acceleration in cash flow generation compared to the Lead the future plan. The guidance for 2026 and 2028 is as follows:

“Trust the future, our new strategic plan, marks a key milestone for the Group,” said Christel Heydemann, Chief Executive Officer of Orange. “Lead the future 2023–2025 delivered on all its objectives: Orange is now simpler, stronger and more efficient, and our focus on value creation has reinforced our leadership in fast‑evolving telecoms and digital markets.

In a world where digital complexity and risks are rising, and where connectivity remains critical, trust is our competitive edge. With Trust the future, we will accelerate growth in profitable B2C services and trusted solutions for enterprises — guided by strong ambitions in Customer intimacy, Innovative growth and Excellence at scale. Leveraging all levers in our hands, with disciplined investment, efficiency powered by AI and the commitment of our teams, the plan will generate superior cash flow and EPS growth.

In France, in a market which remains competitive, we are shifting to a full fibre network with the implementation of our copper decommissioning industrial project while stepping up our efficiency efforts.

The reconsolidation of MasOrange will create a step change and further strengthen our group profile.

Our direction is clear: to be, and remain, the trusted partner for everyday digital life – serving individuals, organizations and communities – by providing always available connectivity and beyond that, innovative digital services.”

Trust the future, three ambitions in action

In a world where digital complexity and risks are rising, expectations for quality of service, security and simplicity are rising fast, while AI is reshaping every industry. In this context, trust is becoming a decisive choice criterion. Trust the future makes that advantage concrete — through reliable networks, embedded cybersecurity, responsible data and AI practices, and seamless user experiences.

Trust is the foundation upon which the Group will build its future.

This strategy will be deployed around three key strategic ambitions: customer intimacy, innovative growth and excellence at scale.

1 – The first ambition is Customer intimacy,

Moving from best-in-class experience to deeper, more personal, more predictive relationships. The Group will better leverage its two strong assets: its 3404 million customer base and its powerful brand to grow its customer base, reduce churn and enhance loyalty. This will enable the Group:

- To continue to grow its customer base — particularly in Africa and Middle East (where demographics and the adoption of smartphones, data and fixed broadband continue to

rise) and in underpenetrated segments in European countries (by accelerating convergence and FTTH). By 2028, Orange aims to add around 40 million additional fixed and mobile customers. - Inspire loyalty and reduce churn thanks to leading NPS and refreshed loyalty programs. Orange aims to improve churn rates by up to 3 points in European countries.

- Augment relevant customer interactions with digital, through next-gen apps, AI digital assistants and marketplaces to foster smart cross-sell and enhance Customer Value Management.

2 – The second ambition is to expand through Innovative growth.

In all markets, Orange will scale fast growing services beyond connectivity. The Group will invest in profitable, fast-growing retail and business services to deliver €1bn in additional revenues by 2028 (vs 2025) on those services that split as follows.

- The Group will scale B2C services beyond connectivity where it has experience and already a positive track record: cybersecurity, home security, Orange travel, international

money transfers in Europe (including France and Spain), Mobile Money and Max it in Africa and Middle East. The Group aims to generate an additional €500m of revenue on a

portfolio of double-digit growth services by 2028. - Orange Business and Orange Cyberdefense will build on their leadership in cyberdefence, grow trusted cloud solutions and trusted AI services, and invest in specific verticals such as defense and health. The Group aims to generate an additional €500m of revenue on trusted B2B services by 2028; and Orange Cyberdefense has an objective to reach €2bn in revenue by 2030.

Orange, contrary to some peers, has retained control of most of its infrastructure; the Group will continue to manage its unique infrastructure assets to create value and develop the wholesale monetization of these assets.

3 - Third ambition is to deliver Excellence at scale leveraging Group scale for technological leadership and efficiency.

Orange’s multi-local model is a unique strength — the reach of a global group and the agility of teams that are deeply rooted in their countries.

- Orange is leading with next-generation networks — fiber, 4G, 5G — and will keep modernizing by decommissioning 2G, 3G and copper in Europe, while enhancing efficiency through AI and resilience with complementary solutions such as satellite.

- Orange will make its innovation capabilities and pooled expertise available across the Group, with shared platforms that accelerate time-to-market for digital services; It will

step up mutualized operational efficiency, for instance in procurement with €1bn in expected savings. - The Group will further expand AI deployment in every part of its daily operations, enhancing its use in four areas: customer experience, to develop highly-personalized interactions with a target of moving towards 100% of customer interactions augmented by AI; network management, covering multiple use-cases including, for example, the use of tools to decrease network downtime; internal processes, to improve operating efficiency; and in opening up new revenue opportunities, such as customer value management (CVM) and B2B LLM solutions. By 2028, Orange aims to achieve €600m in value5 generated from AI and an eCAPEX/sales ratio of around 14%.

Trust the future will be translated into concrete financial outcomes in the Group divisions

In France, in a mature market, Trust the future will aim to deliver stable retail services excl. PSTN over the next three years. The Group is implementing an ambitious efficiency plan to offset the decline of copper-related revenues amounting to €800 million euros. This will lead to “stable plus” EBITDAaL CAGR over 2025-2028. The combination of a “stable plus” EBITDAaL over the period, and a reduction in eCAPEX of over 300m€, will fuel a solid growth in “EBITDAaL – eCAPEX”. The Group expects Operating Cash Flow to grow by above +3% CAGR 2025-28.

In Africa and Middle East, the Group anticipates an average high single-digit revenue growth over the next three years (CAGR 2025-28). This growth is expected to be reflected in EBITDAaL, which will also grow at a high single-digit rate. The combination of high-growth EBITDAaL and a stable eCAPEX/sales ratio will enable the Africa and Middle East division to achieve high singledigit growth in Operating cash flow (CAGR 2025-28).

In Europe, Orange is expecting low single-digit growth in service revenues and low-to-mid-single digit EBITDAaL growth. Meanwhile, eCAPEX / sales is projected to decline to 14% thanks to strict CAPEX discipline. As a result, Operating Cash Flow is expected to reach a high single-digit CAGR 2025-28.

In Europe, Orange is expecting low single-digit growth in service revenues and low-to-mid-single digit EBITDAaL growth. Meanwhile, eCAPEX / sales is projected to decline to 14% thanks to strict CAPEX discipline. As a result, Operating Cash Flow is expected to reach a high single-digit CAGR 2025-28.

At Orange Business, continued portfolio alignment to trusted solutions and efficiency gains are expected to improve continuously the EBITDAaL year-on-year trend toward stabilization, while Orange Cyberdefense—reported within the segment—intends to build on its momentum with a 2030 revenue objective of €2bn.

For MasOrange, the Group anticipates low to mid-single-digit revenue growth, and low singledigit EBITDAaL growth, which, combined with the eCAPEX/-sales ratio at c. 12%, will lead to a mid to high single-digit CAGR 2025-28 growth of the Operating cash flow. With over €350m of synergies already achieved, the synergy target is confirmed to at least €500m. Full reconsolidation expected in H1 2026 will strengthen the Group’s profile and cash generation.

For MasOrange, the Group anticipates low to mid-single-digit revenue growth, and low singledigit EBITDAaL growth, which, combined with the eCAPEX/-sales ratio at c. 12%, will lead to a mid to high single-digit CAGR 2025-28 growth of the Operating cash flow. With over €350m of synergies already achieved, the synergy target is confirmed to at least €500m. Full reconsolidation expected in H1 2026 will strengthen the Group’s profile and cash generation.

Sustainable value creation is the north star

The Group’s strategic ambitions - Customer intimacy, Innovative growth and Excellence at scale - will fuel topline growth and drive EBITDAaL-eCapex growth. The Group is expecting a +2-point improvement in Operating cash flow margin between 2025 and 2028.

The full reconsolidation of MasOrange, expected in H1 2026, will bring a significant step-up to cash generation. Organic cash flow is expected to grow double-digit and reach c.€5.2bn by 2028, while Free cash flow all-in growth will outpace Organic cash flow growth.

The Group is introducing a new value-creation metric, the adjusted Earnings Per Share, which is expected to grow at c.10% CAGR 2025-28.

Group Capital allocation policy will be driven by sustainable value creation.

eCAPEX to sale ratio will decrease toward c.14% by 2028.

Attractive shareholder return remains a priority. The dividend for 20266 will increase again to 0.79€ per share (payable in 2027), with a new floor at 0.85€ for 2028, while the Group will preserve a solid balance sheet, with a progressive deleveraging towards its mid-term objective of c. 2x net debt/EBITDAaL by end 2028 (excluding any impact from a potential transaction in France).

In terms of M&A, the priority will be in-market consolidation—especially the optionality in France—and selective bolt-on M&A, notably in cybersecurity and in Africa Middle East.

Attractive shareholder return remains a priority. The dividend for 20266 will increase again to 0.79€ per share (payable in 2027), with a new floor at 0.85€ for 2028, while the Group will preserve a solid balance sheet, with a progressive deleveraging towards its mid-term objective of c. 2x net debt/EBITDAaL by end 2028 (excluding any impact from a potential transaction in France).

In terms of M&A, the priority will be in-market consolidation—especially the optionality in France—and selective bolt-on M&A, notably in cybersecurity and in Africa Middle East.

Commitment to people, society and the planet is the bedrock of the Group’s strategy.

Concerning people, Orange will continue to invest in skills, employability and leadership so that teams can adapt and lead in a fast-moving environment. Engagement remains strong, with 81% of employees being proud to work for Orange (Annual Engagement Survey, January 2026).

For society, the Group will extend digital trust to all by targeting the availability of tieredprotection offers—B2C/B2B cybersecurity and dedicated solutions for young people—in 100%

of countries by 2030, and by providing free training in digital uses to 6 million people by 2030 vs 2021, notably through its Orange Digital Centers.

For the Planet, Orange reiterates its environmental trajectory: a 45% reduction in greenhouse gas emissions on all scopes by 2030 vs. 2020, and Net Zero Carbon by 2040, driven by energy efficiency, decarbonization, circular economy initiatives and country-specific adaptation plan to address more extreme weather events.

- Year on year on a comparable basis

- Subject to closing in 2026

- Compounded Annual Growth Rate

- Including MasOrange and FiberCos

- vs >€300m achieved in 2025, value = revenue preserved or uplift, Opex & eCapex gross savings based on identified use cases

- Subject to shareholder’s approval

Bouygues Telecom, Free-iliad Group and Orange submit a joint non-binding offer to acquire a large part of Altice's activities in France

Bouygues Telecom, Free-iliad Group and Orange submit a joint non-binding offer to acquire a large part of Altice's activities in France

Bouygues Telecom, Free-iliad Group and Orange announce they have submitted a nonbinding offer to acquire a large part of the telecommunications activities of the Altice group in France.

While ensuring continuity of service for SFR customers and in a mature market, the deal would make it possible to:

- step up investments in superfast network resilience, in cyber security and in new technologies such as artificial intelligence;

- consolidate control over strategic infrastructure in France; and

- maintain a competitive ecosystem for the benefit of consumers.

Today, Bouygues Telecom, Free-iliad Group and Orange submitted a joint non-binding offer to enter into negotiations with a view to acquiring a range of activities from the Altice group in France. It covers most of SFR's assets, but excludes, in particular, stakes in Intelcia, UltraEdge and XP Fibre and Altice Technical Services, as well as the Altice group's activities in French overseas departments and regions.

This offer corresponds to a total enterprise value of €17 billion for the Altice group assets concerned in France and gives an indicative implied enterprise value for the whole of Altice France of more than €21 billion1.

Bouygues Telecom, Free-iliad Group and Orange envisage to share out the targeted activities as follows:

- the B2B business to be taken over mainly by Bouygues Telecom, and by Free-iliad Group;

- the B2C business to be shared between Bouygues Telecom, Free-iliad Group and Orange;

- the other assets and resources (in particular infrastructure and frequencies) to be shared between Bouygues Telecom, Free-iliad Group and Orange, with the exception of SFR's mobile network in less densely populated areas, to be taken over by Bouygues Telecom.

The split of price and value would be around 43% for Bouygues Telecom, 30% for Free-iliad Group and 27% for Orange.

Subject to the seller's acceptance of the non-binding offer, the submission of a confirmatory offer will be conditional upon the completion of due diligence, as well as a financial and operational assessment confirming the assumptions of the indicative offer.

Subject to the seller's acceptance of the non-binding offer, the submission of a confirmatory offer will be conditional upon the completion of due diligence, as well as a financial and operational assessment confirming the assumptions of the indicative offer.

The transaction will be subject to prior consultation with the relevant employee representative bodies. It will then have to be cleared by the relevant regulatory authorities before it can be completed.

At the end of these stages, any assets that cannot be transferred immediately to each of the three operators concerned would be transferred to a joint company responsible for managing operations during a transition period that would notably allow for the gradual migration of customers. The joint company will rely on Altice group employees.

There is no certainty at this stage that this indicative offer will lead to an agreement.

1Based on publicly-available information and estimates in analysts’ research publications on part of the assets not targeted by the offer: the stakes in Intelcia, UltraEdge and XP Fibre and Altice Technical

Services as well as the Altice group's activities in the French overseas departments and regions.

Services as well as the Altice group's activities in the French overseas departments and regions.